Photo by Erik Mclean on Unsplash

Photo by Erik Mclean on Unsplash

What Are Graded Cards?

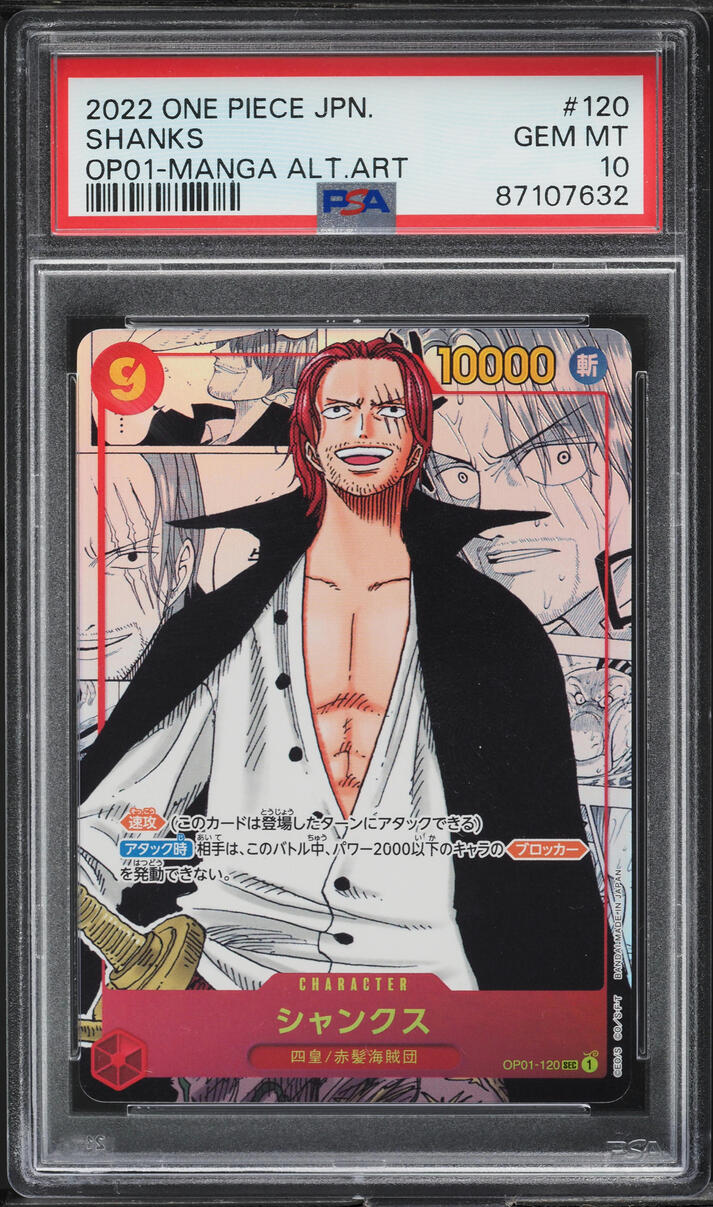

Graded cards are trading cards that have been professionally evaluated by third-party companies like PSA (Professional Sports Authenticator), Beckett Grading Services (BGS), or SGC. These companies assess the card’s condition on a scale, typically from 1 (poor) to 10 (gem mint). They also authenticate the card, ensuring it's not a counterfeit, and then encase it in a protective, tamper-proof slab.

What Are Raw Cards?

Raw cards, on the other hand, are cards that haven’t gone through this grading process. They’re in the condition they were found or purchased—straight from a booster pack or a trade. They can be mint, near-mint, or show signs of wear and tear. In short, raw cards have no official grade, so their condition is judged by eye.

Pros of Investing in Graded Cards

-

Guaranteed Authenticity and Condition

One of the biggest perks of graded cards is knowing exactly what you’re getting. The grade confirms the card’s condition, which eliminates guesswork and protects against buying a counterfeit or damaged card. -

Higher Long-Term Value

Graded cards, especially those that score high (9 or 10), tend to hold and increase in value more consistently than raw cards. Collectors often pay a premium for the peace of mind that comes with knowing the exact grade. -

Protection and Durability

Grading companies encase cards in a durable, tamper-proof slab. This means the card is protected from physical damage, environmental wear, and handling, which can give you confidence that your investment won’t degrade over time. -

Easier to Sell

Because the grading process removes uncertainty about condition, graded cards are easier to sell at market value. Buyers know what they’re getting, and the grade serves as a universally recognized standard.

Cons of Investing in Graded Cards

-

Higher Upfront Cost

Graded cards tend to be more expensive than their raw counterparts. If you’re looking to buy in bulk or start with a smaller budget, graded cards might not offer the best bang for your buck. -

Limited Upside

Once a card is graded, its condition is locked in. A raw card, on the other hand, could be graded and potentially score high, giving it a much higher resale value than it would have ungraded. -

Grading Fees

If you're planning to grade your own raw cards, the fees can add up. Depending on the company, the value of the card, and the service level, grading fees can range from $20 to over $200 per card.

Pros of Investing in Raw Cards

-

Lower Entry Price

Raw cards are generally cheaper upfront. This allows investors to acquire more cards for the same amount of money, diversifying their collection and increasing the chances of finding hidden gems. -

Potential for Higher Gains

The allure of raw cards lies in the possibility of discovering one in mint condition, grading it, and selling it for a substantial profit. If you’re able to spot cards in great condition, you could see a bigger return than you would on a pre-graded card. -

More Flexibility

With raw cards, you have the freedom to decide if and when to get them graded. This can be strategic if market conditions or card values change, allowing you to maximize your investment.

Cons of Investing in Raw Cards

-

Risk of Counterfeits and Damaged Cards

Raw cards come with more risk. Since they haven’t been authenticated, you might end up buying counterfeit or damaged cards. And without professional grading, it’s harder to verify their true condition. -

Condition Guesswork

It takes a trained eye to judge the condition of raw cards accurately. Even the tiniest flaw can reduce the card’s value dramatically. This guesswork can lead to overpaying for cards that won’t grade as high as expected. -

No Immediate Value Boost

Raw cards don’t command the same premium as graded cards. Unless you’re willing to take the time and money to grade them, they won’t see the same kind of price appreciation that a high-grade slabbed card would.

Which Should You Choose?

If you're just starting out or have a limited budget, raw cards can be a great entry point. You can build a collection at a lower cost and learn the ropes of grading as you go. However, this strategy requires a sharp eye for card condition and a willingness to take on some risk.

On the other hand, if you’re looking for a safer, long-term investment and are willing to spend a little more upfront, graded cards are the way to go. They offer security, easier resale, and consistent value growth—ideal for collectors who prefer a hands-off approach.

Final Thoughts

There’s no one-size-fits-all answer when it comes to investing in graded versus raw cards. It depends on your budget, risk tolerance, and long-term goals. A balanced portfolio of both graded and raw cards can give you the best of both worlds—steady value growth from graded cards and the thrill (and potential profit) of hunting for raw card gems.

Whatever route you choose, investing in trading cards is as much about passion as it is about profit. Enjoy the process, and happy collecting!

Trending

Trending