Photo by Hashem Al-Hebshi on Unsplash

Photo by Hashem Al-Hebshi on Unsplash

Introduction: More Than Just Cardboard

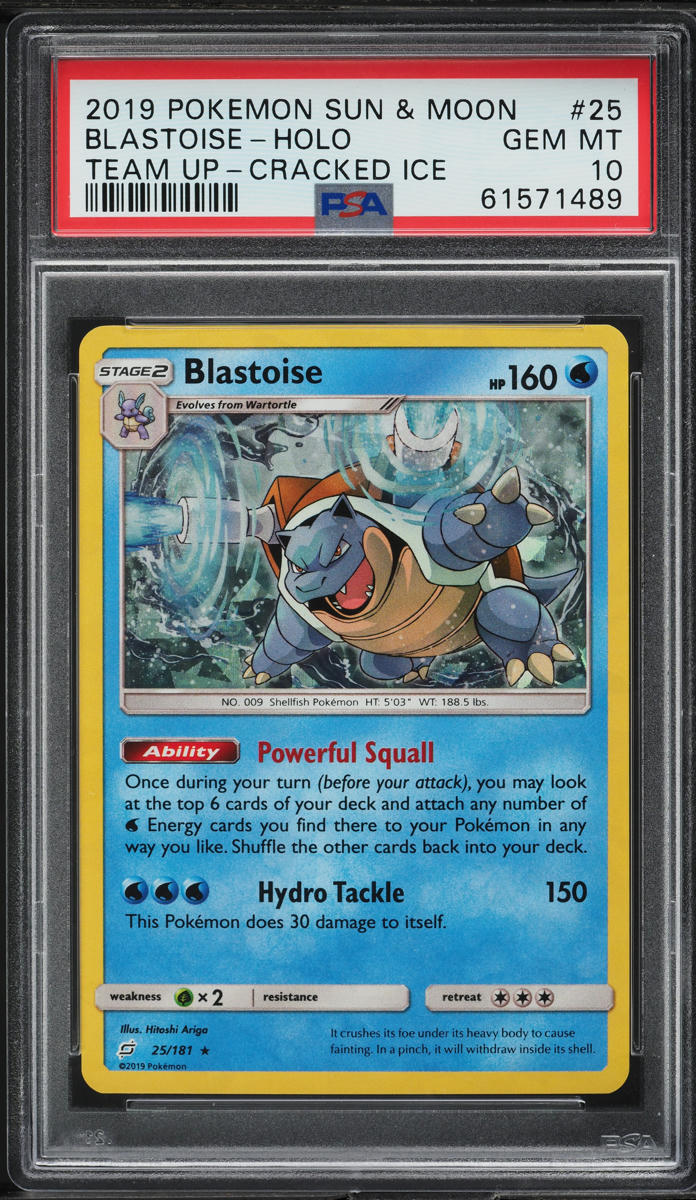

Trading card collecting isn't just about pieces of printed cardstock—it's a complex emotional journey that blends passion, nostalgia, and financial strategy. Welcome to the intricate world where your childhood memories meet investment potential.

The Emotional Drivers of Collecting

1. Nostalgia: The Powerful Memory Magnet

Remember that first Pokemon card you treasured as a kid? That's nostalgia in action. Collectors aren't just buying cards; they're purchasing fragments of memories. This emotional connection often drives irrational purchasing decisions that defy pure financial logic.

Key Psychological Insights:

- Nostalgia triggers powerful positive emotions

- Childhood memories inflate perceived value

- Collectors often overpay for cards with personal significance

2. The Thrill of the Hunt

Collecting is an adventure. The rush of finding a rare card is comparable to winning a lottery. This psychological reward system keeps collectors constantly searching, trading, and investing.

Psychological Mechanisms:

- Dopamine release during successful finds

- Collecting triggers the brain's reward circuit

- Creates an addictive feedback loop

Emotional vs. Rational Investing

The Hype Cycle Trap

Trading card markets are highly susceptible to emotional waves. A viral video, a tournament win, or social media buzz can send card values soaring—or crashing.

Red Flags of Emotional Investing:

- Buying cards during peak hype

- FOMO (Fear of Missing Out) purchases

- Ignoring market fundamentals

- Holding onto cards due to sentimental attachment

Rational Investment Strategies

- Detach emotional value from market value

- Use data-driven decision-making

- Set clear investment goals

- Develop a disciplined approach

The Cognitive Biases Affecting Collectors

1. Confirmation Bias

Collectors often seek information that confirms their existing beliefs about a card's value, ignoring contradictory evidence.

2. Sunk Cost Fallacy

"I've already invested so much, I can't stop now." This thinking leads to continued investment in declining assets.

3. Anchoring Bias

The first price you see becomes your reference point, potentially skewing future valuation perceptions.

Managing Emotional Investment

Practical Strategies

Create a Systematic Approach

- Develop a clear investment strategy

- Set strict buying and selling rules

- Use objective criteria for card selection

Diversify Your Collection

- Don't put all your money in one game or card type

- Spread risk across different TCGs

- Balance emotional picks with strategic investments

Continuous Learning

- Stay informed about market trends

- Join collector communities

- Learn from experienced investors

The Dark Side: When Collecting Becomes Compulsive

Warning Signs

- Spending beyond financial means

- Neglecting personal finances

- Experiencing anxiety about collection

- Prioritizing collecting over other life responsibilities

Balancing Passion and Prudence

The Golden Rule

Collect with your heart, but invest with your head.

Expert Insights

"Successful card collecting is 30% knowledge, 70% emotional intelligence." - Anonymous Collector

Conclusion: Your Collection, Your Journey

Trading card collecting is a unique blend of emotional experience and financial strategy. By understanding the psychological mechanisms at play, you can transform your hobby into a more balanced and potentially profitable endeavor.

Trending

Trending